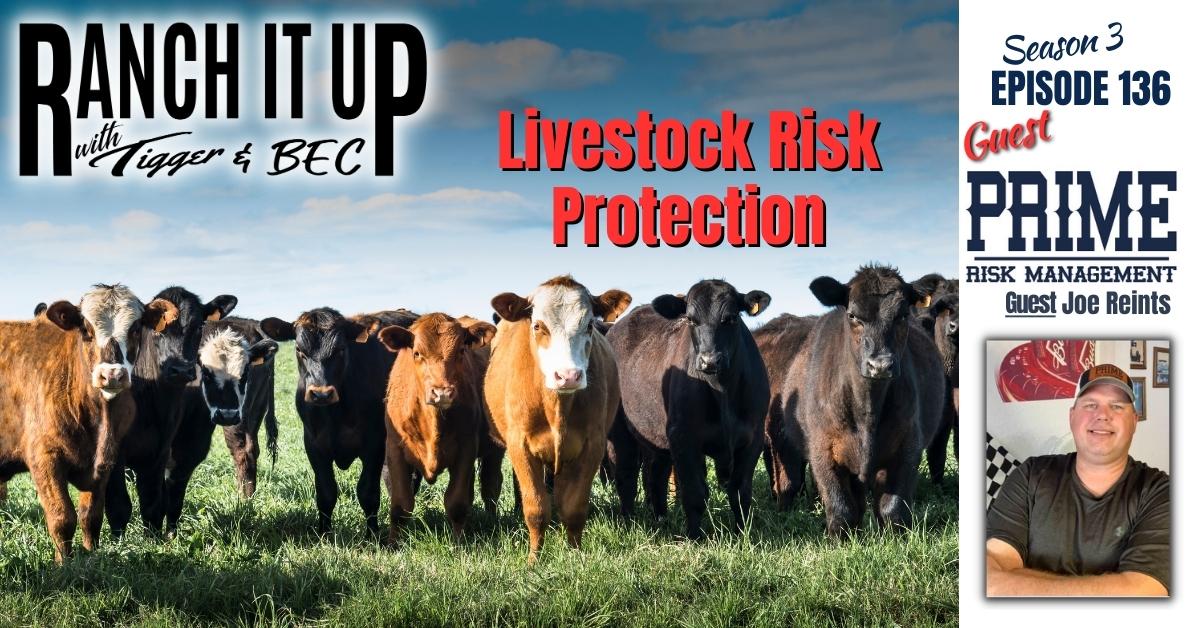

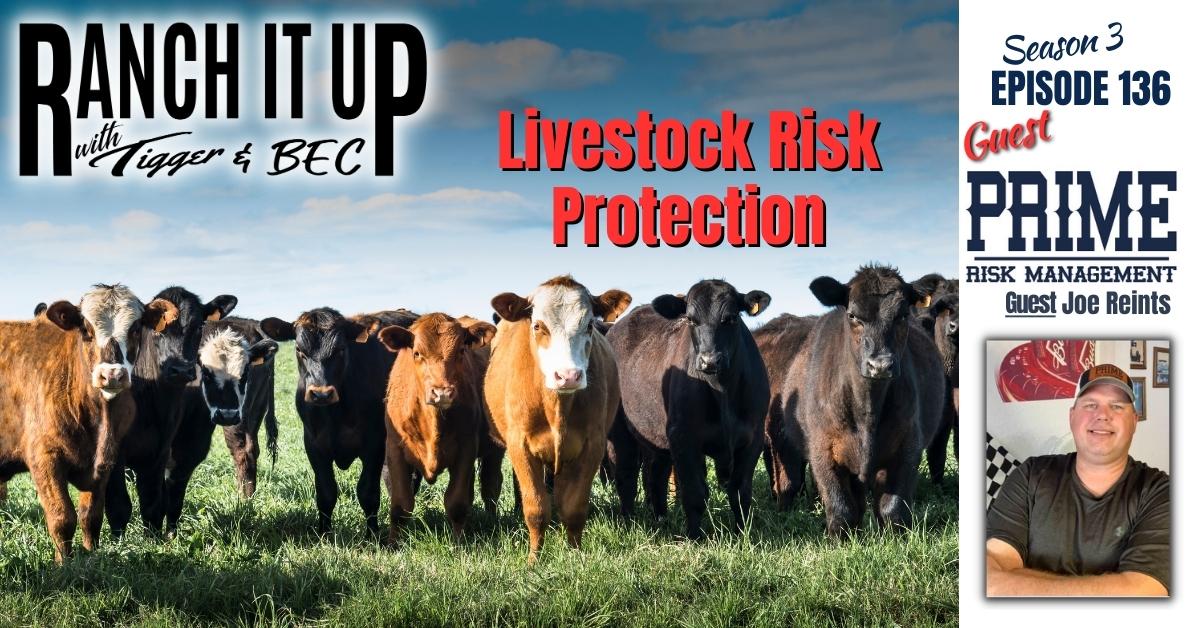

Just How Livestock Danger Security (LRP) Insurance Policy Can Safeguard Your Livestock Financial Investment

Livestock Danger Protection (LRP) insurance coverage stands as a trustworthy guard against the unpredictable nature of the market, supplying a strategic approach to safeguarding your possessions. By delving into the intricacies of LRP insurance policy and its multifaceted advantages, livestock manufacturers can strengthen their investments with a layer of safety and security that goes beyond market fluctuations.

Comprehending Animals Danger Defense (LRP) Insurance Coverage

Comprehending Livestock Threat Security (LRP) Insurance coverage is important for livestock manufacturers seeking to alleviate monetary threats linked with price variations. LRP is a government subsidized insurance policy item created to protect producers versus a decrease in market value. By providing coverage for market value declines, LRP helps producers secure a floor cost for their animals, making sure a minimum level of revenue despite market changes.

One key aspect of LRP is its versatility, enabling manufacturers to personalize protection levels and plan sizes to fit their particular demands. Manufacturers can pick the variety of head, weight array, insurance coverage cost, and coverage duration that line up with their production goals and take the chance of tolerance. Understanding these customizable alternatives is essential for producers to efficiently handle their price danger exposure.

Additionally, LRP is available for numerous livestock kinds, including cattle, swine, and lamb, making it a versatile threat management tool for livestock manufacturers across different fields. Bagley Risk Management. By familiarizing themselves with the ins and outs of LRP, manufacturers can make educated decisions to protect their investments and ensure financial stability despite market uncertainties

Benefits of LRP Insurance Policy for Animals Producers

Animals producers leveraging Animals Danger Security (LRP) Insurance get a calculated advantage in protecting their investments from cost volatility and securing a steady financial ground amidst market unpredictabilities. One essential benefit of LRP Insurance coverage is price defense. By establishing a floor on the cost of their livestock, producers can mitigate the threat of significant economic losses in the event of market slumps. This allows them to intend their budgets better and make educated choices about their procedures without the consistent fear of price changes.

In Addition, LRP Insurance offers manufacturers with assurance. Understanding that their financial investments are guarded versus unexpected market changes permits manufacturers to concentrate on various other facets of their organization, such as improving animal health and wellness and well-being or enhancing manufacturing processes. This satisfaction can bring about boosted productivity and earnings over time, as manufacturers can run with more self-confidence and security. On the whole, the advantages of LRP Insurance coverage for livestock producers are significant, supplying a useful tool for handling danger and ensuring economic safety and security in an uncertain market setting.

Exactly How LRP Insurance Policy Mitigates Market Dangers

Mitigating market risks, Livestock Risk Protection (LRP) Insurance offers animals producers with a trustworthy guard versus rate volatility and financial uncertainties. By using security against unexpected price declines, LRP Insurance coverage assists producers protect their investments and preserve monetary stability despite market changes. This kind of insurance policy enables livestock manufacturers to secure in a rate for their animals at the start of the policy duration, guaranteeing a minimal price level despite market changes.

Steps to Safeguard Your Animals Financial Investment With LRP

In the world of farming danger management, carrying out Livestock Risk Security (LRP) Insurance entails a critical procedure to guard financial investments against market fluctuations and unpredictabilities. To secure your animals investment successfully with LRP, the first action is to assess the particular dangers your procedure encounters, such as cost volatility or unforeseen climate occasions. Next, it is critical to research study and select a reputable insurance copyright that provides LRP plans tailored to your animals and organization requirements.

Long-Term Financial Safety With LRP Insurance

Ensuring enduring monetary security via the usage of Animals Threat Defense (LRP) Insurance policy is a prudent long-term method for farming producers. By including LRP Insurance coverage into their risk administration strategies, farmers can secure their livestock financial investments against unanticipated market changes and adverse occasions that could jeopardize their financial health over time.

One key advantage of LRP Insurance for lasting financial security is the satisfaction it provides. With a trustworthy insurance policy in area, farmers can minimize the economic dangers connected with volatile market conditions find and unexpected losses as a result of aspects such as illness episodes or natural catastrophes - Bagley Risk Management. This stability permits manufacturers to focus on the everyday procedures of their livestock business without continuous bother with possible monetary problems

Additionally, LRP Insurance coverage offers an organized method to managing danger over the long-term. By setting details insurance coverage degrees and picking ideal recommendation periods, farmers can customize their insurance coverage plans to align with their financial goals and take the chance of tolerance, making sure a protected and lasting future for their animals procedures. To conclude, investing in LRP Insurance coverage is a positive technique for agricultural manufacturers to achieve enduring financial protection and secure their source of incomes.

Verdict

In final thought, Animals Risk Security (LRP) Insurance policy is an important device for livestock producers to minimize market threats and protect their financial investments. It is a smart option for safeguarding livestock financial investments.